Here’s a sample of how that spreadsheet could look: Churn Rate: Expected cancellations every month.Marketing Budget Scale: How much is the budget climbing month over month this is usually a percentage increase.Marketing Budget: The estimated marketing spend for a given month (this data is imported from the SG&A spreadsheet).Max/Min CAC: Maximum and minimum Cost of Acquisition.CAC Trend: As your budget grows, your CAC will tend to increase, and you should account for that in your model.In our model, we have a formula that takes into account the following variables:

Predictable Revenue is one of the reasons why I love SaaS businesses: once you have a good idea of your CAC and your Churn, you can pretty accurately estimate you much money you are going to be making in X amount of time or increasing your marketing budget by Y. These values are tracked in the Revenue Spreadsheet.

LIFEHACKER BUDGET SPREADSHEET PDF MANUAL

LIFEHACKER BUDGET SPREADSHEET PDF UPDATE

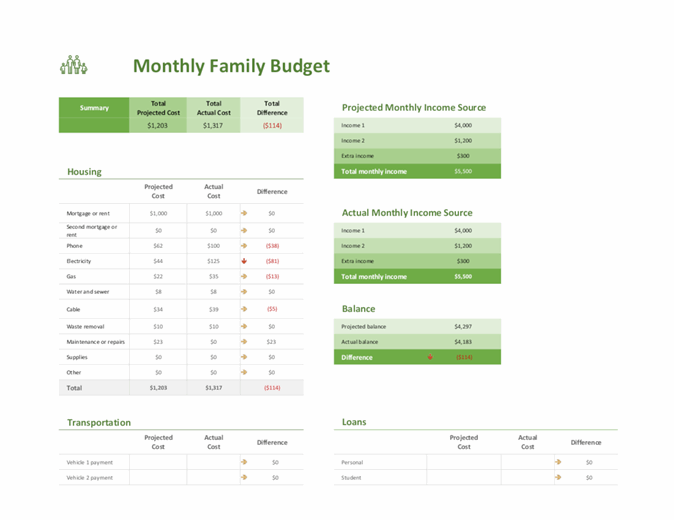

This is the main expenses sheet and the one you will want to update on a regular basis based on your week over week spend. A SaaS product, for example, should have MRR and Churn as the core drivers/variables, while also accounting for estimated user cost of acquisition vs. This sheet should be adapted based on your Business Model. This is a standard Financial Statement sheet taking into account Income, Balance Sheet, and Cash Flow. A list of variables that you can comfortably adjust here, and measure their impact on the financials for the future. The Summary Spreadsheet also holds the Dashboard. If you’ve just raised money, then this should be modified to look into your expansion budget. No formulas should be calculated here this should just reflect important lines and results for your current company status: if you’re running low on cash, this should be very focused on your bank statements. This is a custom page that you should build based on your most immediate needs.

Let’s go over the sections: Summary Spreadsheet

All the formulas I use I found with Google Searches and adapted them to my needs. Again, I encourage you to use a more ‘universal’ platform that will allow you to share it with anyone. I ran a quick Google Search for ‘Startup Financial Models’ and came across a few subscription tools that offer this service. THE ALL-MIGHTY SPREADSHEETĪll financial models are spreadsheets, and my best suggestion is to go with Google Sheets, which will not only allow you to keep int in sync with other teammates but to automate certain task and data inputs based on your other spreadsheets in the cloud. I’ll elaborate on the main features we used to make the model work in our favor- it should work for most companies. Over the years, I’ve simplified it to remove unnecessary modules and adapted it to serve the purposes of our SaaS business model. The spreadsheet we use is an evolution of a template created by our investors at Carao Ventures. To give you an example, about nine months ago a quick prediction in our financial model enabled us to make our company profitable while duplicating our marketing budget. Being on top of your Financial Model and business budget can make a difference and can enable managers and founders to make game-changing decisions. If there is one quintessential task a startup CEO needs to be in charge of is not letting the company running out of money.

0 kommentar(er)

0 kommentar(er)